In The Radical Portfolio Theory, Jeff Park, Head of Alpha Strategies and Portfolio Manager at Bitwise Asset Management, explains the death of one of the most fundamental assumptions in investing:

Equities represent risk and growth, while treasuries represent safety.

The underlying technical assumption is that through mechanics of interest rates, they're negatively correlated which leads to probably the most traditional portfolio design: 60% equities / 40% bonds—the classic "60/40 portfolio."

This is no longer true.

In the post-COVID market this correlation reversed from negative to positive:

If correlation between stocks and bonds remains positive the whole setup loses its meaning.

Bonds Are Volatile

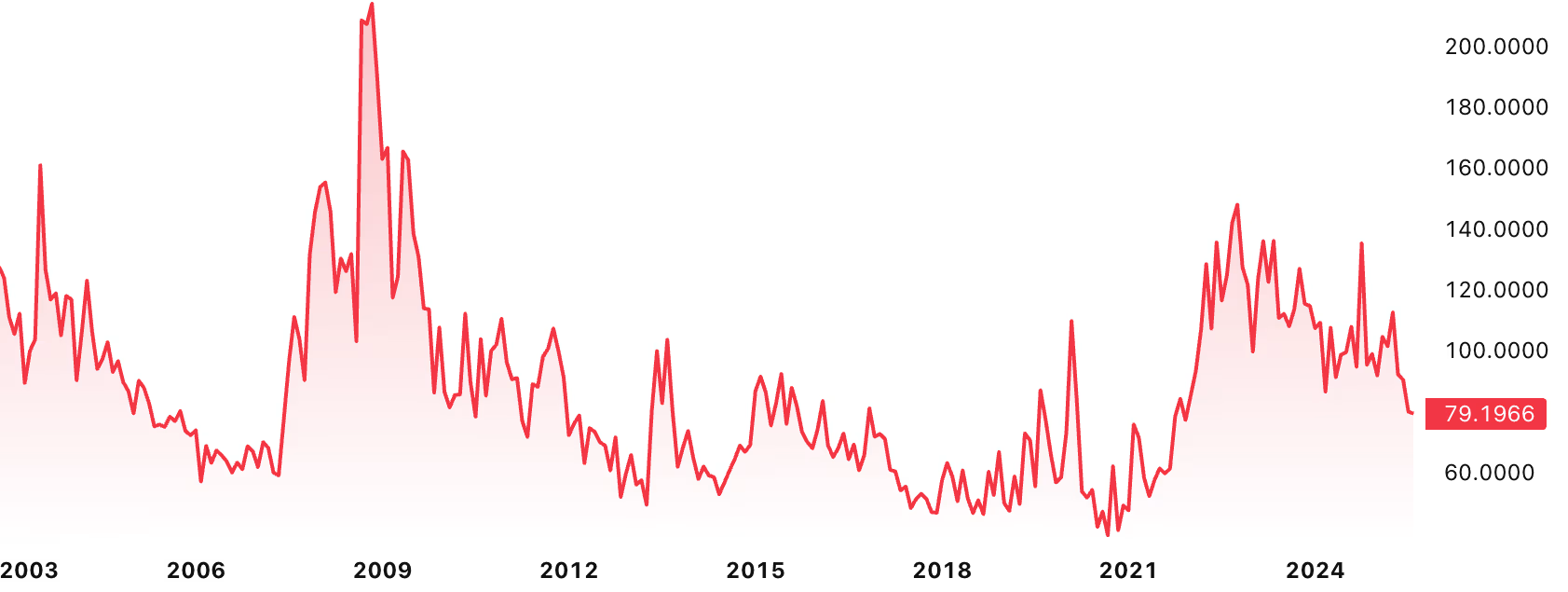

The MOVE index shows that bonds actually can be very volatile:

The 79 on the chart means annual volatility of 7.9% of Treasury bond prices, which in the moment when you may need them the most, can spike significantly.

While long-term holders may stay unaffected, if you planned to sell bonds or bond ETFs to rebalance your portfolio by buying cheap stocks during the 2008 crisis, or the COVID turmoil—you faced the unfavorable mark-to-market prices.

Everything Is a Global Carry Trade

The foundational observation from the essay is that the whole global economy became extremely correlated, relying on the assumption of the Dollar's strength, effectively becoming just one big "global carry" trade.

The traditional carry trade means that you:

- borrow in low-interest currency (like Japanese Yen at 0%)

- invest in high-interest currency (like US Dollar at 5%)

- profit from the interest rate differential

However, Jeff's global carry trade is a broader concept. The system is a massive, interconnected web where:

- Japan funds US consumption by buying US bonds/stocks with cheap money

- China holds US treasuries to maintain trade relationships

- Everyone is essentially leveraged off US dollar strength and low rates

Being "long global carry" means owning assets that benefit from this system.

Both stocks and bonds became part of the same trade, and that's why the traditional 60/40 is not working as diversification any longer.

Time is liquid energy.

—Jeff Park

Fundamentally, the traditional financial system is based on a time manipulation trick: instead of producing enough energy now, it borrows it from the future.

On the other side, there are assets backed by energy spent now: human workforce, commodities, Bitcoin.

Fundamental Investing No Longer Drives The Market

Finally, the essay points out that fundamental investing has become rare, and index investing becomes simply an inflation hedge, while many traditional metrics like GDP are engineered to support the mainstream narrative, but not necessarily reveal the reality of the situation anymore, and the real risks that may be worth diversifying against.

The new 60/40: The Radical Portfolio

The 60/40 ratio never had any strong technical justification—all it was is a nice round number representing the idea of "rather growth, but also safety."

Jeff takes this catchy format, but proposes a new approach to diversification:

60% Long Global Carry / 40% Short Global Carry

Which you can also read as "rather compliant, but also resilient."

The compliant 60% are all traditional investing assets: equities, bonds, or even your primary residence. They're all part of the same bet on the current state of affairs, and that the system continues doing well.

The other 40% are resilient assets that provide insurance. Here are some examples:

- Bitcoin

- Physical gold

- Offshore real estate

- Prediction market bets

You may now understand where the "radical" comes from—definitely not the playbook that a traditional financial advisor would (or is even allowed to) recommend.

While even including prediction markets in a general purpose investing framework seems truly radical, the great observation here is that rather than just exotic assets or gambling, they can be used as a classic conservative insurance. Buying a small bet on an unlikely, but tragic scenario can be a valid strategy for increasing the safety of your portfolio.

Self-custody

One thing that this framework explains well is the importance of self-custody. While both Bitcoin and Bitcoin ETF can give you exposure to Bitcoin growth in times of prosperity, in the moment when you may need it the most, they represent completely different risks.

Even excluding some catastrophic scenarios, simple rebalancing during a market crash is not possible when the market is closed—which is standard practice in moments of the biggest volatility.

While there are many benefits of Bitcoin or gold ETFs, they're still compliant assets. In the radical 60/40 you can have both, but in a way, they stay on opposite sides of the split.

The low liquidity that makes alternative assets harder to move is actually part of their strength. The more liquid an asset is, the more it becomes part of the system and becomes subject to the same forces, and eventually correlates with it.

| Compliant | Resilient |

|---|---|

| 60% | 40% |

| Public | Private |

| Centralized | Decentralized |

| Third-party custody | Self-custody |

| Maximalist state | Minimalist state |

| High leverage | Low leverage |

| Abundant liquidity | Natural volatility |

| Stocks, bonds, REITs, Bitcoin ETFs | Physical Bitcoin, gold bars, offshore real estate |

| System-dependent, correlated | System-independent, uncorrelated |

| Easy to buy/sell | Requires effort and knowledge |

Bitcoin: The New Resilience

While the original essay doesn't focus on Bitcoin, for any investor in digital assets the connection, and appeal will be obvious and self-evident. Bitcoin is the natural perfect resilience asset checking all the boxes, and deserving to be part of every portfolio. While a typical "non-orthodox" advice usually suggested 1-5%, from the "radical portfolio theory" perspective 20-40% allocation doesn't sound that crazy.

That said, the "radical" framework provides both great explanations, and applicable strategies, bringing clarity for investors looking into many new opportunities coming from traditional finance like MSTR, STRK, or the upcoming multi-crypto ETF from Grayscale.

As convenient as they are, they're part of the status quo you may want to diversify against.